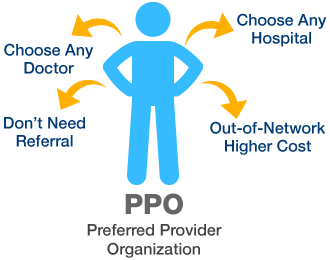

A Preferred Provider Organization (PPO) is a type of health insurance arrangement that emphasizes choice and flexibility for its members while also fostering cost-effective healthcare. The term “Preferred” highlights the network of healthcare providers who have entered into agreements with the insurance company, designating them as preferred options for plan members. These providers agree to specific terms and negotiated rates for their services, which typically results in lower out-of-pocket costs for patients.

How PPOs Work

How PPOs Work in Simple Terms:

- PPOs have a network of healthcare providers with discounted rates.

- You can choose any provider, in or out of the network.

- In-network care usually costs less.

- Out-of-network care is covered but may cost more.

- No need for referrals to see specialists.

- There’s an annual deductible, and you may have copayments or coinsurance.

- Claims for in-network care are straightforward.

- You have access to a wide range of specialists.

- PPOs are flexible for travellers.

- Consider premiums and out-of-pocket costs when choosing a plan.

Advantages of PPOs

- Provider Choice: Freedom to choose healthcare providers in or out of the network.

- No Referrals: No need for referrals to see specialists.

- Specialist Access: Access to a wide range of specialists within the network.

- Out-of-Network Coverage: Coverage for out-of-network care, especially for specialized services.

- Lower In-Network Costs: Reduced deductibles, copayments, and coinsurance for in-network care.

- Traveller-Friendly: Convenient for travellers, as you can seek care in various regions.

- Easy Claims: Hassle-free claims processing for in-network care.

- No Gatekeepers: No approval or referrals are required to see specialists.

- Coverage Options: Comprehensive coverage options to fit different needs and budgets.

- Cost-Flexibility Balance: A balance between flexibility and cost-effectiveness.

Choosing the Right PPO Plan

- Assess Your Needs: Evaluate your healthcare requirements, including age, health status, and family needs.

- Check Network: Confirm your preferred providers are in-network for cost savings.

- Compare Plans: Compare plan options, considering premiums and costs.

- Out-of-Network: Understand out-of-network coverage and potential higher costs.

- Prescription Coverage: Check medication coverage and costs.

- Calculate Costs: Estimate total annual healthcare expenses.

- Additional Benefits: Look for extra benefits like wellness programs.

- Financial Assistance: Consider subsidies if eligible.

- Review Policy Details: Read terms, limitations, and exclusions.

- Specialists: Ensure in-network specialists meet your needs.

- Travel Coverage: Assess healthcare coverage while traveling.

- Use Resources: Contact the insurance company for clarification.

- Seek Guidance: Consult experts if the process seems overwhelming.

- Annual Review: Reevaluate your plan yearly to match changing needs.

Costs Associated with PPOs

Preferred Provider Organizations (PPOs) provide flexibility in healthcare choices however include associated costs. These prices can vary depending on the precise plan and your character’s healthcare needs. The fundamental fees related to PPOs encompass premiums, deductibles, copayments, coinsurance, and capacity out-of-community prices. Premiums are the ordinary bills you make to hold your insurance coverage. Deductibles are the initial out-of-pocket expenses you need to pay before the coverage begins protecting your healthcare.

Copayments are constant quantities you pay for positive offerings or prescriptions. Coinsurance is the proportion of prices you share with the coverage corporation. It’s vital to not forget those expenses while selecting a PPO plan, balancing the power of provider preference together with your price range and healthcare wishes. In-network care generally offers decreased fees, making it an attractive option for those looking to manipulate healthcare costs.

Conclusion

In the end, Preferred Provider Organizations (PPOs) offer a flexible and bendy approach to medical health insurance. They provide policyholders with the freedom to pick out healthcare vendors both inside and outside the community, making them suitable for the ones who’ve specific docs or professionals they prefer. PPOs additionally offer access to a huge variety of experts without the need for referrals, taking into consideration well-timed and convenient healthcare decisions.

Frequently Asked Question

MLCs are members of the legislative council, while MLAs (Members of Legislative Assembly) are members of the lower house. MLCs are often indirectly elected or nominated, while MLAs are directly elected by the public.

Unlike Health Maintenance Organizations (HMOs), PPOs do not require a primary care physician or referrals to see specialists. PPOs also provide coverage for out-of-network care, although at higher costs.

PPOs offer a wide choice of providers, no need for referrals to see specialists, access to specialists, coverage for out-of-network care, lower in-network costs, and flexibility for travelers.