The rewards on your investment are not based on the success of the stock market because PPF is a non-market linked program. The government sets the PPF interest rate, which is then updated every three months. PPF interest rates are now 7.1% annually.

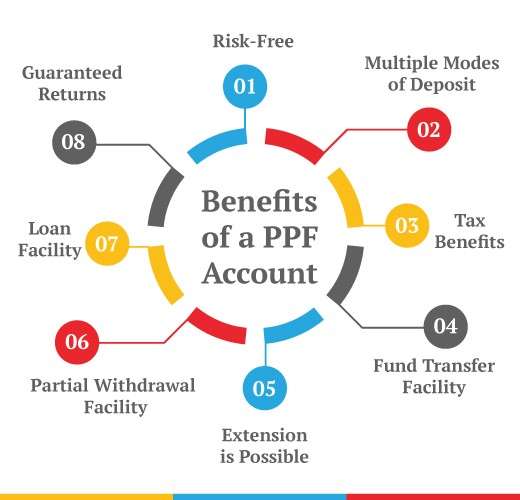

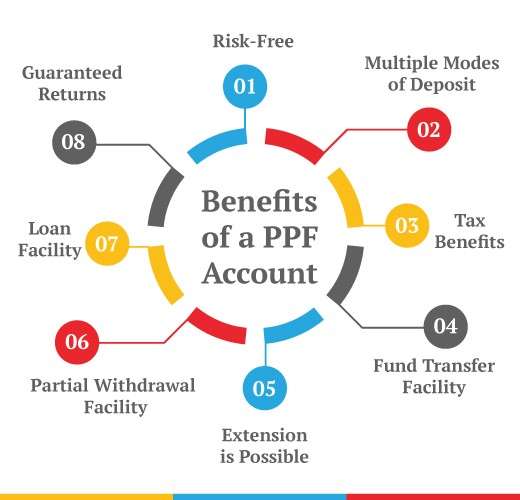

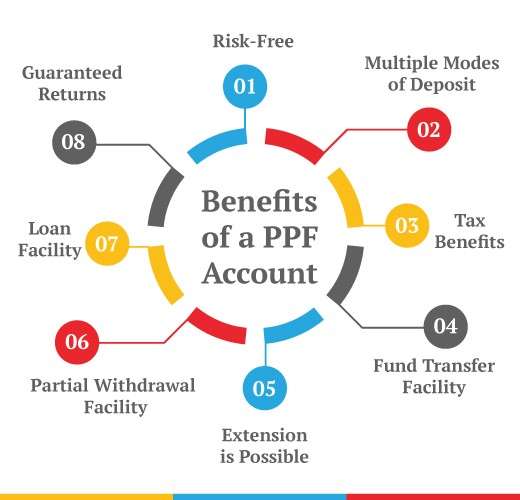

PPF is a popular long-term savings scheme that offers a number of benefits, including tax benefits, guaranteed returns, safety, liquidity, and long-term investment. If you are looking for a safe and tax-efficient investment option, PPF is a good option to consider.

PPF Full Form: About

A PPF form is a form that must be completed in order to start a PPF account. PPF forms come in a variety of shapes, each of which serves a particular function.

Some of the most common PPF forms include:

- Form A: You may create a new PPF account using this form.

- Form B: This form is used to make a contribution to an existing PPF account.

- Form C: This form is required to make a PPP account withdrawal.

- Form D: This form is required when moving a PPF account between banks or post offices.

- Form E: The PPF account can be closed using this form.

How to open a PPF account

- Choose a bank or post office. You can open a PPF account at any bank or post office that offers PPF accounts.

- Collect the necessary documents. You will need to provide the following documents to open a PPF account:

- PAN card

- Aadhaar card

- Proof of address

- Passport size photograph

- Fill out the PPF form. You will need to fill out a PPF form to open a PPF account. The form can be downloaded from the website of the Government of India or the bank or post office that you are opening the account with.

- Submit the form and documents. Once you have filled out the form and gathered all of the necessary documents, you will need to submit them to the bank or post office.

- Pay the initial deposit. The minimum initial deposit for a PPF account is Rs. 500. You can also deposit a higher amount, up to the maximum of Rs. 1,50,000 per year.

- Get your PPF passbook. Once your PPF account is opened, you will be given a PPF passbook. This passbook will contain all of the details of your PPF account, including your account number, the amount of money you have invested, and the interest you have earned.

Features of PPF account

| Feature | Description |

|---|---|

| Account type | Public Provident Fund |

| Lock-in period | 15 years |

| Interest rate | 7.1% per annum (current) |

| Minimum investment | Rs. 500 per year |

| Maximum investment | Rs. 1,50,000 per year |

| Tax benefits | Contributions are eligible for tax deduction under Section 80C of the Income Tax Act |

| Withdrawal | You can withdraw money from your PPF account after 5 years, subject to a penalty of 1% |

Why is PPF so popular

PPF is so well-liked for a variety of causes. Here are a few of the most significant justifications:

- Tax benefits: Section 80C of the Income Tax Act permits tax deductions for PPF donations. This implies that investing in PPF can help you save up to Rs. 1,50,000 in taxes each year.

- Guaranteed returns: The government sets the PPF interest rate, which is then updated every three months. As a result, you can be confident that your investment will provide a profit.

- Safety: Your investment is secure since PPF is a government-backed program.

- Liquidity: You can withdraw your money from PPF after 5 years, subject to a penalty of 1%.

- Long-term investment: PPF is a long-term investment, thus you can make investments for up to 15 years. Your money has time to compound and expand as a result.

PPF Interest rate

An historical table of PPF interest rates is shown below:

| Quarter | Interest rate (% per annum) |

|---|---|

| April-June 2023 | 7.1 |

| January-March 2023 | 7.1 |

| October-December 2022 | 7.1 |

| July-September 2022 | 7.1 |

| April-June 2022 | 6.8 |

| January-March 2022 | 6.8 |

| October-December 2021 | 6.8 |

| July-September 2021 | 6.8 |

Importance of PPF

Here are some of the specific importance of PPF:

- PPF is a good way to save for retirement: PPF is a fantastic option to save for retirement because to its lengthy lock-in period. PPF allows you 15 years of contributions, and then you can take the funds when you reach retirement. As a result, you’ll have a consistent income stream during your retirement.

- PPF can help you achieve your financial goals: PPF can assist you in achieving your financial objectives, such as purchasing a home or automobile or paying for your child’s education. After 15 years, the PPF funds can be used to achieve your financial objectives.

- PPF can help you save taxes: Section 80C of the Income Tax Act permits tax deductions for PPF donations. This implies that investing in PPF can help you save up to Rs. 1,50,000 in taxes each year.

- PPF is a safe investment: Your investment is secure since PPF is a government-backed program. Government payments to PPF investors will not be missed.

PPF Withdrawal

The following are some critical details of PPF withdrawal:

- After five years, you can withdraw money from your PPF account with a 1% penalty.

- After 15 years, you can take the whole sum from your PPF account without incurring any fees.

- You can also take money out of your PPF account for a number of things, including the purchase of a home, covering medical costs, paying for your child’s education, getting married yourself or to one of your children, or in the event of the account holder’s passing.

- You must submit a withdrawal form to the bank or post office where you hold your PPF account in order to make a withdrawal from it. You will also need to present identification and address evidence.

- After submitting the withdrawal form, the withdrawal amount will be credited to your bank account within 10 working days.

- You can only withdraw money from your PPF account in multiples of Rs. 500.

- You must pay a 1% penalty on the amount taken if you withdraw funds from your PPF account before it matures.

- Except in exceptional situations, you cannot take funds from your PPF account before the age of 55.

FAQs

The Indian government introduced the Public Provident Fund (PPF) as a long-term savings program in 1968. PPF’s primary goal is to promote small individual deposits and give them a safe and tax-effective investment choice.

A financial year’s worth of PPF investments is limited to a total of Rs. 1,50,000. You have the option of making a one-time donation or regular payments. The least investment you may make if you make payments in regular installments is Rs. 500 each month.

No such thing as a PPF salary exists. Public Provident Fund, or PPF for short, is a government-sponsored savings program. It is not a wage; rather, it is a long-term investment choice that provides safety, guaranteed returns, and tax advantages.