The Tata Mutual Fund (MF) Login portal presents buyers with steady and convenient get right of entry to to their mutual fund funding accounts. Through the Tata MF login, investors can control their portfolios, song the overall performance of their investments, and carry out transactions together with purchasing, redeeming, and switching mutual fund gadgets. The login procedure is straightforward, requiring a registered username and password or a PAN-connected login option for superior protection. Once logged in, users can get right of entry to customized reviews, view their transaction history, installation systematic funding plans (SIPs), and stay updated on fund-associated news and updates. The platform is designed to offer a unbroken revel in, making it easy for buyers to live in control of their investments anytime, from anywhere.

- Overview of Tata MF Login

- Step-by-Step Guide Login Process of Tata MF Login

- Troubleshooting Common Issues Tata MF Login

- Benefits of Using Tata MF for Mutual Fund Investments

- Exploring Features and Tools Available After Tata MF Login

- Conducting Transactions Online of Tata MF Login

- Ensuring Security and Privacy of Tata MF Login

- Leveraging Customer Support Services of Tata MF Login

- Embracing the Future of Investing of Tata MF Login

- How to Redeem Mutual Fund Units After Tata MF Login

- Frequently Asked Question (FAQs)

Overview of Tata MF Login

| Aspect | Description |

|---|---|

| Platform | Tata Mutual Fund’s online portal provides access to investor accounts. |

| Purpose | Enables investors to manage their mutual fund investments conveniently from anywhere. |

| Registration | Investors need to register online using their folio number and personal details. |

| Login Credentials | Unique username and password are required for logging in securely. |

| Features | Provides access to portfolio details, transaction history, fund performance, and educational resources. |

| Transactions | Allows investors to buy, redeem, and switch mutual fund units, set up SIPs, and update personal details. |

| Security | Implements robust security measures including encryption and multi-factor authentication. |

| Customer Support | Offers comprehensive support via phone, email, and live chat for resolving queries and issues. |

| Convenience | Facilitates 24/7 account access, empowering investors to manage their investments at their convenience. |

| Future | Embraces technological advancements to enhance user experience and foster financial empowerment. |

| Website | https://www.tatamutualfund.com/ |

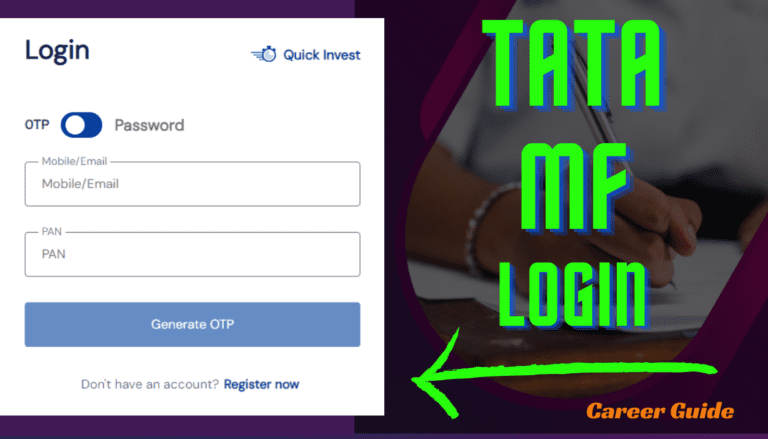

Step-by-Step Guide Login Process of Tata MF Login

| Step | Description |

|---|---|

| 1. Visit Website | Open your web browser and navigate to the official Tata Mutual Fund website. |

| 2. Locate Login | Look for the “Login” or “Sign In” button prominently displayed on the homepage. |

| 3. Click Login | Click on the Login button to proceed to the login page. |

| 4. Enter Username | Enter your unique username provided during the registration process. |

| 5. Enter Password | Input your password associated with your Tata Mutual Fund account. |

| 6. Verify CAPTCHA | Complete any CAPTCHA or security verification prompts to ensure secure login. |

| 7. Click Sign In | Click on the “Sign In” or “Login” button to submit your login credentials. |

| 8. Access Account | Upon successful authentication, you will gain access to your Tata MF Login account dashboard. |

| 9. Navigate | Navigate through the various sections such as portfolio, transactions, or statements as required. |

| 10. Logout | Ensure to log out of your account once your tasks are completed for security and privacy purposes. |

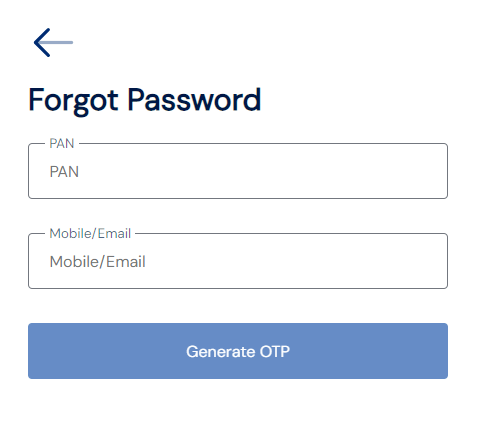

Troubleshooting Common Issues Tata MF Login

| Common Issue | Troubleshooting Solution |

|---|---|

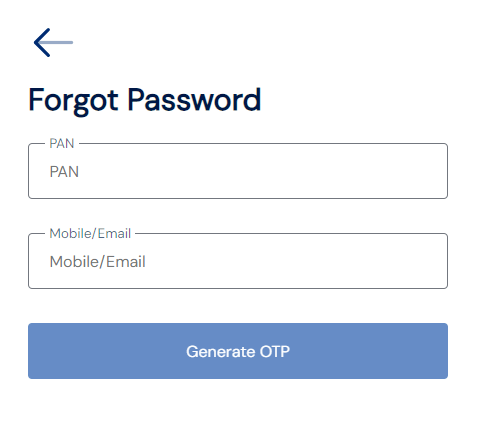

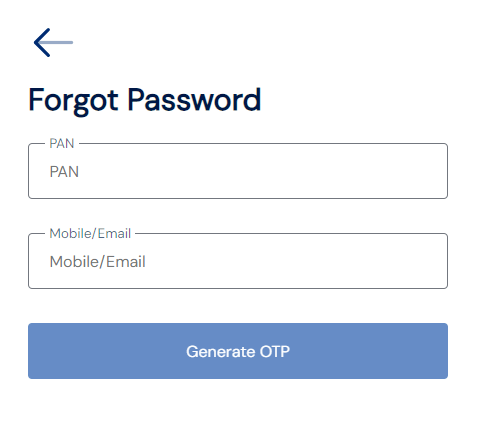

| Forgotten Username or Password | Click on the “Forgot Username” or “Forgot Password” option on the login page to initiate the retrieval process. |

| Locked Account | Contact Tata MF Login customer support team via phone, email, or live chat to unlock your account. |

| Incorrect Credentials | Double-check the username and password for accuracy, ensuring correct capitalization and spelling. |

| Browser Compatibility | Try accessing the login page using a different web browser or ensure your current browser is updated to the latest version. |

| CAPTCHA or Security Verification | Complete the CAPTCHA or security verification prompts accurately to proceed with the login process. |

| Technical Glitches | Refresh the login page, clear browser cache and cookies, or try accessing the website at a later time. |

Benefits of Using Tata MF for Mutual Fund Investments

Diverse Investment Options: Tata MF gives a wide range of mutual fund schemes, including equity, debt, hybrid, and ELSS budget, catering to one of a kind funding desires and threat appetites.

Professional Fund Management: Expert fund managers with massive marketplace understanding control Tata MF schemes, ensuring sound funding selections and portfolio control.

Consistent Track Record: Tata MF has a sturdy track file of turning in regular returns over the years, making it a trusted choice for buyers.

Tax Efficiency: Tata MF gives tax-saving alternatives which includes ELSS (Equity Linked Savings Scheme), which gives tax blessings beneath Section 80C of the Income Tax Act.

Systematic Investment Plans (SIPs): Investors can begin small with SIPs, allowing for disciplined and everyday investments, which helps in constructing wealth over time.

Transparent Operations: Tata MF keeps a high stage of transparency in its operations, providing traders with specific reviews on fund overall performance, portfolio composition, and fees.

Diversification: Investing in Tata MF permits for diversification throughout various asset instructions and sectors, lowering standard risk within the funding portfolio.

Customer Support: Tata MF offers great customer support with committed helplines and on-line resources to help buyers with their queries and transactions.

Online Convenience: Investors can effortlessly control their mutual fund investments thru Tata MF’s consumer-pleasant on line platform, offering seamless transactions and portfolio tracking.

Reputation and Trust: Backed by the Tata Group, one in all India’s most reputable conglomerates, Tata MF gives a sense of safety and believe for investors.

Exploring Features and Tools Available After Tata MF Login

Portfolio Overview: Access a complete view of your funding portfolio consisting of holdings, asset allocation, and market value.

Transaction History: Review a detailed document of your beyond transactions along with purchases, redemptions, and switches.

Fund Performance: Analyze the overall performance of your mutual fund investments over exceptional time intervals to song growth and returns.

Goal Planners: Utilize purpose-based planning gear to set financial goals, together with retirement making plans, training funding, or wealth accumulation.

SIP Management: Manage your systematic investment plans (SIPs) by way of modifying investment amounts, frequencies, or pausing/resuming SIPs as wanted.

Statement Generation: Generate account statements for unique time intervals to facilitate report-retaining and tax-related documentation.

Research and Insights: Access market research reviews, fund supervisor insights, and educational sources to stay knowledgeable approximately market developments and investment strategies.

Risk Assessment Tools: Use threat assessment tools to evaluate your danger tolerance and align your funding alternatives for that reason.

Alerts and Notifications: Receive indicators and notifications concerning important updates, fund performance modifications, or upcoming investment opportunities.

Customer Support: Connect with customer service representatives for assistance with account-related queries, technical issues, or investment steering.

Conducting Transactions Online of Tata MF Login

Select Transaction Type: Choose the kind of transaction you need to carry out, which includes purchase, redemption, or switch.

Choose Fund: Select the mutual fund scheme in which you desire to transact.

Enter Transaction Details: Input transaction info such as the amount to make investments, gadgets to redeem, or budget to replace from and to.

Confirm Details: Review the transaction info cautiously to make certain accuracy.

Authenticate Transaction: Authenticate the transaction the use of the OTP (One-Time Password) despatched for your registered cell variety or e-mail.

Verify Transaction: Double-test the transaction precis to affirm that the information are correct earlier than finalizing.

Submit Transaction: Submit the transaction request to execute the favored motion.

Receive Confirmation: Receive a transaction confirmation message or e mail acknowledging the successful finishing touch of the transaction.

Monitor Transaction Status: Monitor the fame of your transaction through the transaction history section to ensure it’s miles processed effectively.

Review Account Balance: Check your account balance after the transaction to verify the updated funding holdings.

Ensuring Security and Privacy of Tata MF Login

Strong Password: Create a strong and unique password that consists of a combination of letters, numbers, and special characters.

Secure Username: Avoid the usage of without problems guessable usernames or sharing them with others to prevent unauthorized access.

Multi-Factor Authentication: Enable multi-Factor authentication (MFA) for a further layer of protection, requiring additional verification beyond just a password.

Keep Credentials Private: Never proportion your login credentials, together with username and password, with anybody, along with friends or family participants.

Secure Network: Always log in from a stable community, preferably a non-public and relied on Wi-Fi connection, to prevent interception of sensitive facts.

Avoid Public Computers: Refrain from logging into your Tata MF Login account from public or shared computers to limit the hazard of unauthorized get admission to.

Logout After Use: Always log out of your account after completing your transactions or having access to account information, particularly whilst using shared devices.

Regular Updates: Keep your devices, such as computers, smartphones, and capsules, updated with the ultra-modern safety patches and software program updates.

Monitor Account Activity: Regularly evaluate your account hobby and statements for any suspicious transactions or unauthorized get right of entry to.

Contact Support: Immediately touch Tata Mutual Fund’s customer support in case you note any unusual interest or suspect a protection breach in your account.

Leveraging Customer Support Services of Tata MF Login

Identify Contact Options: Locate the customer support contact alternatives provided at the Tata Mutual Fund internet site or inside the on line portal.

Phone Support: Use the supplied telephone number to directly speak with a customer service representative for fast assistance.

Email Support: Send an e mail to the targeted customer support e mail deal with outlining your question or challenge in element.

Live Chat: Utilize the stay chat feature available on the website to engage in real-time communication with a good agent.

Provide Necessary Details: Clearly articulate your problem or query, supplying important information together with your account records and nature of the hassle.

Be Patient and Polite: Remain patient and courteous whilst interacting with customer support representatives, understanding that they are there to assist you.

Follow Instructions: Follow any instructions or troubleshooting steps furnished with the aid of the assist agent to remedy your issue successfully.

Document Communication: Keep a report of your communication with customer service, inclusive of timestamps, names of representatives, and any solutions proposed.

Seek Clarification: If you do not recognize something or want further rationalization, do not hesitate to ask the customer support consultant for added records.

Express Gratitude: After your question or trouble has been resolved, specific gratitude to the customer support representative for their assistance.

Embracing the Future of Investing of Tata MF Login

Convenience: Enjoy the convenience of managing your investments whenever, anywhere, via Tata Mutual Fund’s consumer-pleasant online portal.

Accessibility: Access a huge range of investment alternatives and economic equipment at your fingertips, empowering you to make knowledgeable selections.

Flexibility: Customize your investment strategy in line with your monetary dreams, chance tolerance, and investment horizon.

Technology Integration: Benefit from technological improvements incorporated into the web platform, enhancing person enjoy and accessibility.

Educational Resources: Access a plethora of tutorial resources, marketplace insights, and research reviews to stay up to date and knowledgeable about investment developments.

Security Measures: Rest confident with sturdy safety features implemented to guard your private and economic information during on-line transactions.

Innovation: Stay in advance with Tata Mutual Fund’s commitment to innovation, constantly introducing new features and tools to decorate the making an investment experience.

Customer Support: Receive devoted customer support services to address queries, offer guidance, and clear up any problems promptly.

Adaptability: Adapt to changing marketplace situations and investor preferences by leveraging the dynamic skills offered by Tata Mutual Fund’s on line platform.

Empowerment: Embrace the future of making an investment by means of harnessing the electricity of era and records to gain your long-term monetary desires with self belief.

How to Redeem Mutual Fund Units After Tata MF Login

Login to Tata MF Account: Visit the Tata Mutual Fund net web page or cellular app and log in the use of your registered credentials (username/password or PAN-linked login).

Navigate to ‘Redeem’ Option: After logging in, visit the ‘Transactions’ or ‘Investments’ section and choose out the ‘Redeem’ alternative from the menu.

Select the Mutual Fund Scheme: Choose the mutual fund scheme from which you need to redeem units. Ensure you pick out the best fund out of your portfolio.

Enter the Number of Units: Specify the range of gadgets you desire to redeem, or you could select out to redeem based on the amount you want (partial or entire redemption).

Confirm Redemption Details: Review the data of your redemption request, such as the gadgets, scheme, and redemption quantity, and ensure everything is correct.

Choose Bank Account for Credit: Select the monetary institution account where you want the redemption proceeds to be credited (associated financial institution bills together with your Tata MF account can be to be had).

Submit the Redemption Request: After confirming all info, put up your redemption request. A confirmation message might be displayed as quickly because the device is complete.

Transaction Acknowledgement: You will accumulate a transaction acknowledgment through e-mail or SMS to your redemption request.

Processing Time: Redemption generally takes 1-three enterprise days for the quantity to be credited on your financial institution account, depending at the form of fund.

Check Redemption Status: You can log in in your Tata MF account to track the repute of your redemption request and study the transaction records.

Frequently Asked Questions (FAQs)

Q1. How do I sign up for Tata Mutual Fund on-line access?

To sign in for online get admission to, visit the Tata Mutual Fund internet site and look for the registration or signup alternative. You will need your folio quantity and private info to complete the registration system.

Q2. What have to I do if I forget about my username or password?

If you forget about your username or password, you could use the “Forgot Username” or “Forgot Password” choice on the login page. Follow the prompts to retrieve or reset your credentials.

Q3. Is Tata Mutual Fund's on-line platform stable?

Yes, Tata Mutual Fund implements strong security measures which includes encryption protocols and multi-aspect authentication to make certain the security and privateness of investors’ non-public and economic statistics.

Q4. Can I behavior transactions on line after logging in?

Yes, after logging in, you may behavior plenty of transactions inclusive of purchasing, redeeming, and switching mutual fund gadgets, putting in place SIPs, and updating non-public statistics.

Q5. How can I touch customer support for help?

You can contact Tata Mutual Fund’s customer service group via phone, electronic mail, or live chat for help with account-associated queries, technical troubles, or investment steering.